14 Reasons to Start Budgeting

Introduction

I started Biblical Budgeting as a part of my journey in personal finances. I am good with numbers but in the past I have had challenges with my own finances and I would call myself a “half and half budgeter”. That means that I sometimes did it and sometimes I did not and sometimes I avoided it”. Maybe some of you can related to that. Let us look at what has individuals start budgeting … 14 reasons to start budgeting.

Budgeting is not a new idea, Jesus points out that it is a sensible and logical to have budgets to manage your circumstances and projects:

Luke 14:28 says “For which of you, intending to build a tower, does not sit down first and count the cost, whether he has enough to finish it.“

I recently came across a website that was seeking the answer as to what peoples motivation was to start budgeting … SITE LINK. The site conducted a survey of its readers looking for what motivated them to implement a budget. The method asked people to explain in their own words rather than via a survey form. There are those who would question this as an accurate survey process from a statistical point of view. However, the answers do provide us with insights.

14 Reasons to Start Budgeting

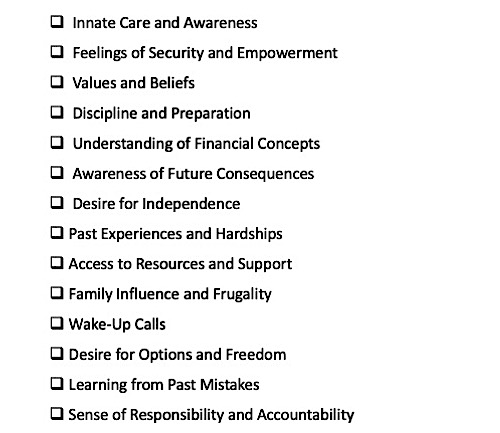

From the answers I distilled 14 reasons to start budgeting. I have presented this as a check list … look at it yourself and mark off which applies to you. I can relate to a number of them myself!

Which of those can you identify with? Just to help you consider and choose I have added a short explanation below the check list.

Check List

14 Reasons to Start Budgeting – Short Explanations

Innate Care and Awareness: Some individuals have an innate ability to be aware of their financial situation and naturally gravitate towards managing their money effectively.

Feelings of Security and Empowerment: Many people, derive a sense of security, empowerment, and freedom from managing their finances well. They see financial management as a means to achieve their goals and enjoy peace of mind.

Values and Beliefs: Individuals are motivated by their values and beliefs, such as being good stewards of their resources, living healthily, and being generous to others.

Discipline and Preparation: For some, discipline is key to financial success. They recognize the importance of saving and planning for the future to avoid financial hardship.

Understanding of Financial Concepts: Learning about concepts like compound interest, can inspire individuals to save and invest wisely to harness the power of their money.

Awareness of Future Consequences: Many individuals, recognize the importance of starting to manage their finances early to avoid financial struggles later in life.

Desire for Independence: Maintaining financial independence and freedom of choice is a strong motivator for individuals, who want to avoid reliance on others for their financial well-being.

Past Experiences and Hardships: Experiences of financial hardship, can serve as powerful motivators to work hard and ensure financial stability for the future.

Access to Resources and Support: Access to trustworthy financial advice and support, can encourage individuals to take control of their finances and seek guidance in managing their money effectively.

Family Influence and Frugality: Family upbringing, can instil frugal habits and financial discipline from a young age, shaping individuals’ attitudes towards money management.

Wake-Up Calls: Harsh experiences, like the loss of a loved one or financial struggles, can serve as wake-up calls, prompting individuals to prioritize financial management.

Desire for Options and Freedom: Many individuals prioritize financial management to have more options and flexibility in life, avoiding being tied down by financial constraints.

Learning from Past Mistakes: Learning from past mistakes, such as struggling with debt, can motivate individuals to take control of their finances and avoid repeating past errors.

Sense of Responsibility and Accountability: Feeling responsible for one’s financial future can drive individuals to take proactive steps to secure their financial well-being and plan for the future.

Summary

Overall, the 14 Reasons to Start Budgeting highlights a combination of personal characteristics, values, past experiences, and future aspirations influences in individuals decisions to manage their finances effectively. Understanding these motivations can help us develop positive financial habits and achieve long-term financial goals.

As Christians our “Values and Beliefs” include “Stewardship” which I will cover in another post.

1 Corinthians 4:2 “Now it is required that those who have been given a trust must prove faithful.”

Where to from here?

Budgeting and Savings is a journey for me and I will be sharing it with you so that we can gain insights from each other. I will be covering budgeting, planning, saving, living with a humble heart, giving and much more as we walk this path. I am Pastor William and I would be excited to hear from any of you with your own stories, experiences and perspectives. Just Contact me.

Note: Unless otherwise stated, Scripture is taken from the New King James Version®. Copyright © 1982 by Thomas Nelson. Used by permission. All rights reserved.